- the voluntary exit of insurers from the market; and

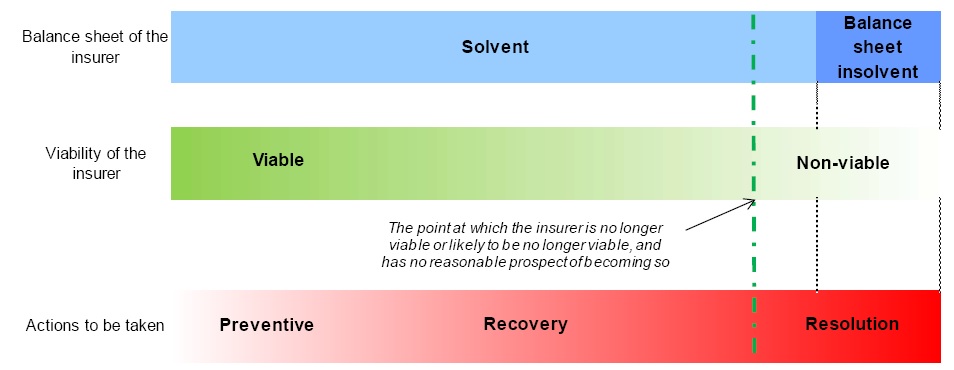

- the resolution of insurers that are no longer viable or are likely to be no longer viable, and have no reasonable prospect of returning to viability.

An orderly process for an insurer’s withdrawal from the business of insurance helps to protect policyholders, and contributes to the stability of the insurance market and the financial system. Jurisdictions should have transparent and effective regimes for an insurer’s exit from the market and the resolution of an insurer.

In this ICP, “resolution” refers to an action taken by a resolution authority towards an insurer that is no longer viable, or is likely to be no longer viable, and has no reasonable prospect of returning to viability. Resolution actions include portfolio transfer, run-off, restructuring, and liquidation.

- “supervisor” is used when the standard and/or guidance involves responsibilities and/or roles of the day-to-day supervisor of the insurer;

- “resolution authority” is used when the standard and/or guidance involves resolution powers and/or processes after resolution has been instituted: this includes supervisors acting under their resolution powers; and

- “supervisor and/or resolution authority” is used when the standard and/or guidance involves responsibilities for planning and/or initiation of resolution and encompasses supervisors acting in their pre-resolution roles (eg before a supervisor or resolution authority institutes resolution and/or obtains any necessary administrative and/or judicial approvals to do so).

The structure and roles of resolution authorities vary across jurisdictions. In some jurisdictions, the resolution authority and the supervisor may be one single authority; in other jurisdictions, resolution of insurers may be the responsibility of one or more separate authorities. In some jurisdictions certain resolution powers may be exercised or overseen by the court. Whatever the allocation of responsibilities, a transparent and effective resolution regime should clearly delineate the responsibilities and powers of each authority involved in the resolution of insurers (see ICP 1 Objectives, Powers and Responsibilities of the Supervisor). Where there are multiple authorities responsible for the resolution of insurers, the resolution regime should empower the relevant authorities to cooperate and coordinate with each other.

Exit from the market refers to cessation of the insurer’s business, in part or in whole. Insurers that meet regulatory requirements may decide to exit from the market on a voluntary basis for business and/or strategic reasons. This is often referred to as ‘voluntary exit from the market’.

Insurers may also be required by the supervisor to exit from the market. For example, supervisory measures and/or sanctions may result in an insurer exiting from the market (ie involuntary exit from the market) (see ICP 10 Preventive Measures, Corrective Measures and Sanctions).

Jurisdictions may need to have mechanisms in place to determine whether the continuity of insurance cover is necessary when insurers exit from the market. Any such continuity should preferably be on the same contract terms, but when necessary, on amended terms. Such mechanisms need to be proportionate to the unique nature and structure of the insurance market in each jurisdiction. Continuity of insurance cover may be facilitated by transferring insurance portfolios to a succeeding insurer, including a bridge institution. Continuity of some insurance contracts, particularly for some non-life products, may be necessary for only a short period (for example 30 or 60 days) so that the policyholder has sufficient time to find another insurer. Facilitating continuity of insurance cover might not be necessary for certain types of insurance products, such as those that are offered by many insurers in a market and which are highly substitutable.

Where an insurer exits from the market and there is no succeeding insurer or no similar insurance products available in the market, mechanisms that facilitate the availability of alternate cover may need to be explored by the supervisor, such as when the exiting insurer delivers insurance contracts that cover risks that may be important to a particular jurisdiction’s economy and/or are compulsory insurance in legislation.

A resolution regime should make it possible for any losses to be absorbed by: i) shareholders; ii) general creditors; and iii) policyholders, in a manner that respects the jurisdiction’s liquidation claims hierarchy. Policyholders should absorb losses only after all lower ranking creditors have absorbed losses to the full extent of their claims. Mechanisms, such as policyholder protection schemes (PPSs), may mitigate the need for the absorption of losses by policyholders.

Depending on the circumstances, appropriate resolution measures may be applied to one or more separate entities in an insurance group, such as: i) the head of the insurance group; ii) an intermediate holding company below the head of the insurance group; iii) an insurance legal entity within the group; iv) a branch of an insurance legal entity within the group; or v) other regulated (eg banks) or non-regulated entities within the group. For other regulated entities within the group (eg banks), a resolution regime relevant to their sector may apply.

Some insurers operate on a cross-border basis through subsidiaries or branches in another jurisdiction, or through providing insurance services on a cross-border basis without setting up a physical presence outside their home jurisdiction. Also, where an insurance legal entity is a member of a group, there could be intra-group transactions and guarantees among insurance legal entities and/or other group entities in different jurisdictions. Cross-border coordination and cooperation, including exchange of information, is necessary for the orderly and effective resolution of insurers that operate on a cross-border basis.

Legislation provides a framework for voluntary exit from the market that protects the interests of policyholders.

The supervisor should require the insurer which voluntarily exits from the market to make appropriate arrangements for the voluntary exit (eg, run-off or portfolio transfer), including ensuring adequate human and financial resources to fulfil all its insurance obligations.

Voluntary exit from the market is initiated by the insurer.

- expected timeframe;

- projected financial statements;

- human and material resources that will be available;

- governance and risk management of the process;

- communication with policyholders about the insurer’s exit from the market; and

- communication to the public.

Insurers that exit from the market on a voluntary basis should continue to be subject to supervision until all insurance obligations are either discharged or transferred to succeeding insurers. Legislation should provide for appropriate requirements for these exiting insurers.

- protects policyholders; and

- provides for the absorption of losses in a manner that respects the liquidation claims hierarchy.

The legislation should support the objective of protecting policyholders. This however does not mean that policyholders will be fully protected under all circumstances and does not exclude the possibility that losses be absorbed by policyholders, to the extent they are not covered by PPSs or other mechanisms. A jurisdiction may have additional resolution objectives in the legislation, such as contributing to financial stability.

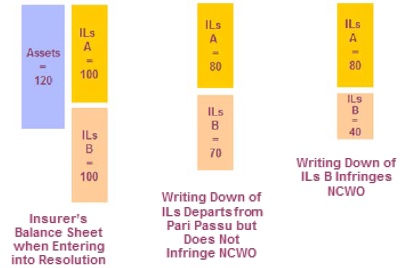

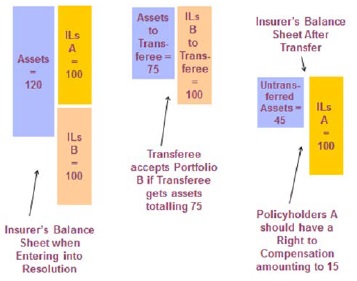

The legislation should provide a scheme for prioritising the payment of claims of policyholders and other creditors in liquidation (liquidation claims hierarchy). Resolution powers should be exercised in a way that respects the hierarchy of creditors’ claims in liquidation. In a resolution action other than a liquidation, creditors should be entitled to compensation if they receive less than they would have received if the insurer was liquidated (ie the “no creditor worse off than in liquidation” (NCWOL) principle). The NCWOL principle may require funding to provide compensation to creditors so that they receive at least as much as they would have received in a liquidation.

Resolution should seek to minimise reliance on public funding. In principle, any public funding used for the resolution of the insurer should be recouped from the insurance sector in a transparent manner. The phrase “reliance on public funding” does not refer to the use of funds from policyholder protection schemes to support the implementation of resolution actions.

In addition to the resolution objectives in Standard 12.2, the framework for resolving IAIGs should also include as an objective the contribution to financial stability, where applicable. A jurisdiction may, at its discretion, choose to rank these resolution objectives with respect to IAIGs.

The resolution of an IAIG seeks to minimise reliance on public funding.

The supervisor and/or the resolution authority requires, as necessary, insurers to evaluate prospectively their specific operations and risks in possible resolution scenarios and to put in place procedures for use during a resolution.

The supervisor may identify risks, specific to an insurer’s circumstances, that would arise in resolution and which may impact achieving the resolution objectives of the jurisdiction. For example, such risks may relate to the insurer’s provision of relevant information to the supervisor or resolution authority, the continuity of certain business operations, and/or the orderly implementation of a jurisdiction’s PPS.

The supervisor should require the insurer to consider such risks and where appropriate, prepare contingency plans to mitigate the risk.

The supervisor should require that the insurer have procedures in place to provide necessary information (eg policyholders’ names, types of their contracts, and the value of each contract) to a relevant organisation (such as a PPS) in a timely manner when the insurer enters into resolution.

Resolution plans are in place for IAIGs where the group-wide supervisor and/or resolution authority, in consultation with the crisis management group of the IAIG (IAIG CMG), deems necessary.

- the IAIG’s activities and its lines of business;

- the number of jurisdictions where the IAIG operates;

- the complexity of the IAIG’s group structure; and

- the potential impact of failure of the IAIG on the financial system and real economy in the jurisdictions in which the IAIG operates.

- the IAIG’s risk management mechanisms; and

- expected costs, benefits and outcomes of the resolution planning requirement.

The group-wide supervisor and/or resolution authority should lead the development of the group-wide resolution plan, in coordination with members of the IAIG CMG, and involve the IAIG as appropriate. To facilitate its implementation, the resolution plan should identify, in particular:

- financial and economic functions that need to be continued to achieve the resolution objectives for the IAIG;

- suitable resolution options to preserve such functions or wind them down in an orderly manner;

- data requirements for the IAIG’s business operations, structures and financial and economic functions;

- potential barriers to effective resolution and actions to mitigate those barriers; and

- actions to protect policyholders.

- the insurance legal entity’s presence in the jurisdiction is large in scope and/or scale;

- the insurance legal entity provides critical and/or non-substitutable insurance coverages; and/or

- its resolution may impact that jurisdiction’s financial system and real economy.

Resolution plans should be reviewed on a regular basis, or when there are material changes to the IAIG’s business or structure or any other change that could have a material impact on the resolution plan, and be updated when necessary. These plans should also be subject to regular reviews within the IAIG CMG.

- requires relevant legal entities within the IAIG to submit necessary information for the development of resolution plan;

- regularly undertakes resolvability assessments to evaluate the feasibility and credibility of resolution strategies, in light of the possible impact of the IAIG’s failure on policyholders and the financial system and real economy in the jurisdictions in which the IAIG operates; and

- requires the IAIG to take prospective actions to improve its resolvability.

Resolvability assessments should be conducted at the level of those entities where it is expected that resolution actions would be taken, in accordance with the resolution strategies for the IAIG, as set out in the resolution plan.

Resolvability assessments should consider if it is feasible and credible for the resolution authority to resolve the IAIG in a way that protects policyholders and contributes to financial stability while minimising reliance on public funds.

Resolvability assessments should be undertaken on a regular basis, or when there are material changes to the IAIG’s business or structure, or any other change that could have a material impact on the resolvability assessment. These assessments should also be subject to regular reviews within the IAIG CMG.

When the resolution plan and/or resolvability assessment identifies potential barriers to effective resolution, the IAIG may be given the opportunity to propose its own prospective actions to improve its resolvability by mitigating these barriers.

The group-wide supervisor and/or resolution authority, in coordination with the IAIG CMG, requires the Head of the IAIG to have and maintain group-wide management information systems (MIS) that are able to produce information on a timely basis, for supervisors and/or resolution authorities, for the purposes of resolution planning and actions.

Information should be available at the Head of the IAIG and the legal entity level.

The IAIG may rely on its existing information system, so long as it fulfils the objectives of producing information on a timely basis for the purposes of resolution planning and actions.

- maintain a detailed inventory, including a description and location, of the key MIS used in material legal entities of the IAIG, mapped to core services and critical functions;

- identify and take steps to address legal constraints on the exchange of management information among material entities of the IAIG (for example, as regards the information flow from individual entities of the group to/from the Head of the IAIG);

- demonstrate, as part of the resolution planning process, that it is able to produce the essential information needed to implement plans within an appropriate period of time; and

- maintain specific information at a legal entity level, including, for example, information on intra-group guarantees booked on a back-to-back basis, or information on the assets supporting policyholder liabilities.

The roles and responsibilities of relevant authorities within a jurisdiction that are involved in exit of insurers from the market or their resolution are clearly defined.

The jurisdiction should have a designated authority or authorities empowered to exercise powers for the resolution of an insurer. Where there are multiple authorities within a jurisdiction, their respective mandates, roles and responsibilities are clearly defined and coordinated.

Where different authorities within a single jurisdiction are in charge of the resolution of an insurer, a lead authority that coordinates the resolution of the insurer should be identified.

An example where a lead resolution authority should be identified is where the insurer has insurance and other financial operations (such as banking), and the authority responsible for the resolution of the other financial operations is different from the authority responsible for the resolution of the insurance operations in the jurisdiction.

Coordination agreements may be established where multiple authorities may be involved in the resolution of an insurer.

The supervisor and/or resolution authority shares information, cooperates and coordinates with other relevant authorities for the exit of insurers from the market or their resolution.

Relevant authorities in this context may include the group-wide supervisor and/or resolution authority, other involved supervisors and/or resolution authorities and others that may need to be involved in the resolution of insurers, such as PPS and supervisors in other financial sectors.

When an insurer voluntarily exits from the market, the supervisor should cooperate and coordinate with other relevant supervisors as necessary.

Cooperation and coordination should include matters, among others, such as consulting with or informing other relevant authorities of eg the anticipated exercise of resolution powers that the resolution authority considers necessary before taking resolution actions, where this is practicable.

When consulting, authorities should seek to determine if coordinated action on the resolution of an insurance group is necessary to avoid or minimise adverse impact on other group entities.

The supervisor and/or resolution authority should seek to achieve a cooperative solution with authorities in other jurisdictions who are concerned with the resolution of the insurance group.

Cooperation and coordination would be crucial when considering resolution action such as ordering the insurer to cease business (for example, when the insurer has overseas branches), freezing the insurer’s assets, and/or removing management of overseas branches, subsidiaries, or holding companies.

Information sharing, cooperation and coordination should be undertaken in a manner that do not compromise the prospect of successful exit or resolution.

Cross-border coordination agreements may need to be established between relevant authorities.

Legislation provides criteria for determining the circumstances in which the supervisor and/or resolution authority initiates resolution of an insurer.

- the insurance legal entity is in breach of the minimum capital requirement (MCR) and there is no reasonable prospect of restoring compliance with MCR;

- the consolidated own funds of the insurance group are lower than the sum of the proportional shares of the MCRs, or minimum capital requirements of the regulated legal entities belonging to the insurance group (eg due to double-gearing);

- the insurer is in breach of other material prudential requirements (such as a requirement on assets backing technical provisions) and there is no reasonable prospect of compliance being restored;

- there is a strong likelihood that policyholders and/or other creditors will not receive payments as they fall due;

- intra-group transactions impede or are likely to impede the ability of the insurer to meet policyholder and/or creditor obligations as they fall due; or

- measures attempting the recovery of the insurer have failed, or there is a strong likelihood that such proposed measures will: i) not be sufficient to return the insurer to viability; or ii) cannot be implemented in a reasonable timeframe.

Legislation provides an appropriate range of powers to resolve insurers effectively. These powers are exercised proportionately and with appropriate flexibility.

Powers to resolve insurers should be exercised in a proportionate manner that resolves the insurer most effectively in light of the circumstances and objectives of resolution. Some powers may not be needed for all insurers but only for insurers that are, for example, of systemic importance in the jurisdiction. Some powers may only affect the insurer, while others may impact contractual rights of third parties (such as a suspension of policyholders’ rights or restructuring of policies).

Some resolution powers are exercised with the aim to stabilise or restructure an insurer and avoid liquidation. Liquidation can be used in conjunction with other resolution powers. Creditors should have a right to compensation where they do not receive at a minimum what they would have received in a liquidation of the insurer under the applicable insolvency regime (NCWOL principle).

If a court order is required for the resolution authority to exercise resolution powers, the time required for court proceedings should be taken into consideration for the effective implementation of resolution actions.

- prohibit the payment of dividends to shareholders;

- prohibit the payment of variable remuneration to, and allow the recovery of monies from, Members of the Board, Senior Management, Key Persons in Control Functions and major risk taking staff, including claw-back of variable remuneration;

- prohibit the transfer of the insurer’s assets without supervisory approval;

- retain, remove or replace the Board, Senior Management and Key Persons in Control Functions;

- take control of and manage the insurer, or appoint an administrator or manager to do so;

- withdraw the license to write new business and put all or part of the insurance business contracts into run-off;

- sell or transfer the shares of the insurer to a third party;

- restructure, limit or write down liabilities (including insurance liabilities), and allocate losses to creditors and policyholders, where applicable and in a manner consistent with the liquidation claims hierarchy and jurisdiction’s legal framework;

- override rights of shareholders of the insurer in resolution, including requirements for approval by shareholders of particular transactions, in order to permit a merger, acquisition, sale of substantial business operations, recapitalisation or other measures to restructure and dispose of the insurer’s business or its liabilities and assets;

- terminate, continue or transfer certain types of contracts, including insurance contracts;

- transfer or sell the whole or part of the assets and liabilities of the insurer to a solvent insurer or third party;

- transfer any reinsurance associated with transferred insurance policies without the consent of the reinsurer;

- temporarily restrict or suspend the policyholders’ rights of withdrawing their insurance contracts;

- stay rights of the reinsurers of the ceding insurer in resolution to terminate or not reinstate coverage relating to periods after the commencement of resolution;

- impose a temporary suspension of payments to unsecured creditors and a stay on creditor actions to attach assets or otherwise collect money or property from the insurer; and

- initiate the liquidation of the whole or part of the insurer.

The choice and application of the powers set out above should take into account whether an insurer’s disorderly failure would potentially cause significant disruption to the financial system and real economy, the types of business the insurer is engaged in, and the nature of its assets and liabilities.

Where the resolution authority takes action which leads to another person taking control of an insurer with a view to restoring, restructuring or running off the business, the resolution authority should continue to be responsible for the orderly resolution of the insurer. In particular, the resolution authority should continue to exercise functions which ensure that the objectives of resolution are met, notwithstanding any additional responsibilities which the person appointed may have to the insurer or to the courts.

Resolution powers should be exercised in a manner that does not discriminate between creditors on the basis of their nationality, the location of their claim, or the jurisdiction where it is payable.

Mechanisms should be in place to (i) enable continuity of cover for policyholders where this is needed and (ii) ensure timely payment of claims to policyholders of the insurer in resolution, with the aim to minimise disruption to the timely provision of benefits to policyholders. A PPS can be one of the mechanisms that can help ensure timely payments to policyholders and minimise disruption.

When requiring contracts to be transferred to another insurer, the resolution authority should satisfy itself that the interests of the policyholders of the transferor and of the transferee are safeguarded. In some cases this may be achieved through varying, reducing or restructuring the transferred liabilities.

Portfolio transfers and transfers of other types of contracts of the insurer in resolution should not require the consent of each policyholder or party to the contract.

Consistent with the liquidation claims hierarchy, insurance liabilities should be written down only after equity and all liabilities that rank lower than insurance liabilities have absorbed losses, and only if the resolution authority is satisfied that policyholders are no worse off than in liquidation after compensation, where necessary.

Information on the period during which policyholders are prohibited from withdrawing from their insurance contracts should be available to policyholders in a transparent manner for the purposes of policyholder protection.

The exercise of stay powers, their scope of application and the duration of the stays should be designed to address the specific situation of the insurer in resolution. For example, the duration of the stay could depend on the type of the insurance or financial contract.

There may be circumstances where resolution powers will need to be exercised at the level of the head of the insurance group and/or non-regulated entities. Resolution authorities should have the capacity to exercise resolution powers directly on such entities within their jurisdiction to the extent necessary and appropriate. Where resolution powers need to be exercised on entities outside of their jurisdiction or legal authority, the resolution authority should cooperate and coordinate with relevant supervisors and resolution authorities in the relevant jurisdictions, to the extent necessary and appropriate.

Unless otherwise specified by the resolution authority, resolution powers exercised on an insurance legal entity (for instance to cease writing business) should also apply to the legal entity’s branches. However, the resolution authority responsible for a branch can also exercise powers toward the branch. In either case, the resolution authorities responsible for the branch and the insurance legal entity should consult and cooperate with one another.

The resolution authority may choose which power, or which combination of powers, is applied to which entity within the group. Different types of powers may be applied to different parts of the entity’s business.

- prohibit the payment of dividends to shareholders;

- prohibit the payment of variable remuneration to, and allow the recovery of monies from, Members of the Boards, Senior Management, Key Persons in Control Functions and major risk taking staff, including claw-back of variable remuneration;

- prohibit the transfer of the IAIG’s assets without supervisory approval;

- retain, remove or replace the Members of the Boards, Senior Management and/or Key Persons in Control Functions;

- take control of, and manage, the IAIG, or appoint an administrator or manager to do so;

- withdraw the licence to write new business and put all or part of the insurance contracts into run-off;

- sell or transfer the shares of the IAIG to a third party;

- restructure, limit or write down liabilities (including insurance liabilities), and allocate losses to creditors and policyholders, where applicable and in a manner consistent with the liquidation claims hierarchy and jurisdiction’s legal framework;

- override rights of shareholders of the IAIG in resolution, including requirements for approval by shareholders of particular transactions, in order to permit a merger, acquisition, sale of substantial business operations, recapitalisation, or other measures to restructure and dispose of the IAIG’s business or its liabilities and assets;

- terminate, continue or transfer certain types of contracts, including insurance contracts;

- transfer or sell the whole or part of the assets and liabilities of the IAIG to a solvent insurer or third party;

- transfer any reinsurance associated with transferred insurance policies without the consent of the reinsurer;

- temporarily restrict or suspend the policyholders’ rights of withdrawing their insurance contracts;

- stay rights of the reinsurers of the ceding insurer in resolution to terminate, or not reinstate, coverage relating to periods after the commencement of resolution;

- impose a temporary suspension of payments to unsecured creditors and a stay on creditor actions to attach assets or otherwise collect money or property from the IAIG;

- establish a bridge institution;

- take steps to provide continuity of essential services and functions including:

- requiring other legal entities within the IAIG (including non-regulated entities) to continue to provide these essential services to the entity in resolution, any successor, or an acquiring entity;

- ensuring that the residual entity in resolution can temporarily provide such services to a successor or an acquiring entity; or

- procuring necessary services from unaffiliated third parties;

- temporarily stay early termination rights associated with derivatives and securities financing transactions; and

- initiate the liquidation of the whole or part of the IAIG.

In some jurisdictions, PPSs can be utilised as a bridge institution to which insurance contracts of the IAIG are transferred.

Essential services mentioned under CF12.7a include, in particular, IT.

Legislation provides that the supervisor is involved in the initiation of the liquidation of an insurance legal entity (or a branch of a foreign insurer in its jurisdiction).

Legislation should define the involvement of the supervisor in a liquidation, which promotes the protection of policyholders. The supervisor should be authorised to initiate, or should be involved in the liquidation of an insurance legal entity, or a branch of a foreign insurer in its jurisdiction.

In many jurisdictions, all resolution actions, including liquidation, may only be initiated by the supervisor and/or resolution authority. However, in some jurisdictions, the liquidation process can be initiated by another person (such as a creditor of the insurance legal entity, the insurance legal entity itself, or the court). If legislation permits another person to initiate liquidation, it should: i) require prior approval of the supervisor, or ii) at a minimum, require prior coordination with the supervisor. If legislation permits another person to initiate liquidation without such prior approval or coordination, it should provide that the supervisor may challenge the person’s action.

Legislation provides a high legal priority to policyholders’ claims within the liquidation claims hierarchy.

- by liquidators, such as claims corresponding to expenses arising from the liquidation procedure;

- by employees;

- by tax or fiscal authorities;

- by social security systems; and

- claims on assets subject to rights in rem (eg through collateral, lien, mortgage).

In some jurisdictions, policyholders receive higher priority but only on a determined part of the insurance legal entity’s assets (eg the assets covering technical provisions). In such jurisdictions, with respect to this portion of the insurer’s assets, policyholders’ claims are generally subordinate only to liquidation expenses.

Mechanisms facilitating timely payment and, when needed, continuity of contracts should be in place. In some jurisdictions, a PPS or other protection mechanisms can contribute to a resolution and ensure timely payment of claims to policyholders. Where a bridge institution is available, this can ensure continuity of insurance products in cases where no insurer present in the market takes over the insurance portfolio of the insurance legal entity that would otherwise be liquidated. A PPS or other protection mechanisms could also ensure compliance with NCWOL principle by providing compensation to policyholders so that none are worse off than in liquidation. In some jurisdictions, a PPS can only pay claims after liquidation has been initiated.

The resolution authority exercises resolution powers in a way that respects the liquidation claims hierarchy and adheres to the NCWOL principle. If the resolution authority departs from the general principle of equal treatment of creditors of the same class (pari passu), the resolution authority substantiates the reasons for such departure to all affected parties.

While respecting the liquidation claims hierarchy, the resolution authority could treat certain types of creditors differently from others in the same class of creditors’ hierarchy. In such cases, the reasons for such a treatment should be transparent and clearly explained. Concerned creditors should be protected by the NCWOL principle and where they do not receive at a minimum what they would have received in a liquidation of the entity they should have a right to compensation.

- two categories of policyholders ranking pari passu where one is covered by a PPS while the other is not; or

- two categories of creditors ranking pari passu but the creditors are different in nature (eg direct policyholders versus cedants).

- settling contracts ranking pari passu at a different pace; or

- reducing (writing down) contracts ranking pari passu at a different rate.

Legislation provides whether insurance liabilities may be restructured and whether policyholders may absorb losses.

- suspending or postponing payments to policyholders;

- amending terms of insurance contracts;

- terminating or restructuring options provided to policyholders;

- reducing the value of current and future benefits;

- early settling of contracts by payment of a proportion of the insurance liabilities to provide a more rapid and cost-effective resolution. This can apply to future determined benefits but also, and in particular in the case of inward (accepted) reinsurance, to future contingent claims; or

- restructuring reinsurance contracts to allow losses to be imposed on cedants as appropriate.

In most cases, approval from the court is required for the restructuring, while in some jurisdictions the resolution authority is empowered to restructure all or part of insurance liabilities without court approval. Restructuring should only occur if it adheres to the NCWOL principle.

Where insurance liabilities may be subject to restructuring in resolution, the resolution authority should clearly communicate information (for example, the processes through which such restructuring is undertaken and the extent that policyholders may be forced to absorb losses) to interested stakeholders.

Where the insurance legal entity belongs to a group and the head of the insurance group is located in the same jurisdiction as the legal entity, mechanisms are in place through which the head of the insurance group is able to be resolved.

When an insurance legal entity is resolved, the resolution of, or the application of some resolution powers to, the head of the group may support or aid the orderly resolution of the insurance legal entity and best ensure the protection of policyholders.

- the Head of the IAIG, and any intermediate holding company within the IAIG;

- non-regulated operational entities within the IAIG that are significant to the business of the group;

- non-insurance financial institutions within the IAIG; and

- branches of insurers within the IAIG.

Resolution actions should be taken for legal entities and branches within the IAIG, that fall within the scope stipulated above, as necessary and appropriate.

The resolution authority has the authority to resolve a branch of a foreign insurer located in its jurisdiction and, in such circumstance, coordinates and cooperates with the supervisor and/or resolution authority responsible for the insurance legal entity.

The resolution authority responsible for a branch should have the ability to support a resolution carried out by the resolution authority of the insurance legal entity which owns the branch or by the resolution authority responsible for the resolution of the insurance group to which the branch belongs.

The resolution process may differ in the jurisdiction of the branch and in that of the insurance legal entity, due, among other things, to different insolvency laws and creditor hierarchies.

Where the resolution authority of the insurance legal entity which owns the branch or the resolution authority responsible for the resolution of the insurance group to which the branch belongs are not taking action, or are acting in a manner that does not take sufficient account of the objectives of resolution in the branch jurisdiction, the resolution authority responsible for the branch may need to take actions of its own initiative.

Where the resolution authority for a branch takes resolution action of its own initiative, it should give prior notification and consult the supervisor or resolution authority of the insurance legal entity which owns the branch and/or the supervisor or resolution authority of the insurance.