- Home

- News and Events

- 2023 Annual Conference

2023 IAIS Annual Conference

The 2023 IAIS Annual Conference took place in Tokyo, Japan on 9-10 November 2023. More than 400 participants from 100 jurisdictions joined the conference.

With the theme “Mind the gap: the role of supervisors in making the global insurance sector more inclusive” the Annual Conference provided an opportunity for updates on the delivery of the IAIS’ Roadmap and plans for the Association’s future work. It included engaging speakers and panels complemented by five roundtables allowing for in-depth discussion on key insurance supervision topics.

Explore this page for an in-depth look at the insights shared during the conference, including summaries of the sessions, video replays and images.

A special thank you to the Financial Services Agency of Japan for hosting the event.

Overview

Session replays

Welcome remarks

The Annual Conference opened with a warm welcome from His Excellency Fumio Kishida, Prime Minister of Japan, and Suzuki Shunichi, Minister of State for Financial Services of Japan.

The Prime Minister shared his belief that “tackling the myriad of social challenges and generating sustainable growth require unlocking the fundamental strength of finances – and that insurance is a strategic tool with a unique role to support better lives”.

He also highlighted the importance of ongoing collaborative work between the public and private sectors. He concluded by stating his enthusiasm and support for Japan’s continued and expanding involvement in IAIS activities.

Suzuki Shunichi, Minister of State for Financial Services, then shared that the Japanese government is putting in place various initiatives to strengthen the financial system. In particular, Japan is addressing social challenges – such as those arising from climate change, digitalisation, declining population and ageing population and increasing geopolitical risks – while continuing to promote economic growth and stability. He reiterated Japan’s support for the IAIS Annual Conference and the timeliness of such an event, bringing together experts to exchange knowledge and experiences over the coming two days.

It was a great honour for the IAIS to welcome such distinguished speakers to kick off the Annual Conference in Tokyo.

Fumio Kishida – Prime Minister of Japan

Shunichi Suzuki – Minister of Finance of Japan

IAIS Executive Committee Town Hall

The IAIS Executive Committee (ExCo) discussion centred on the challenging dynamics of the macroeconomic environment, progress on the IAIS’ work on operational resilience, climate risk, the Fintech Forum’s thematic review on artificial intelligence and machine learning, and ongoing work to further diversity, equity and inclusion in the insurance sector.

The Town Hall began with a fond farewell to immediate past Executive Committee Chair, Vicky Saporta.

The newly appointed ExCo Chair, Shigeru Ariizumi, Vice Minister for International Affairs of the Financial Services Agency (FSA) of Japan, then shared with participants his reflections on the important work ahead to finalise the Insurance Capital Standard (ICS), the societal role of supervisors in addressing protection gaps, and the development of the 2025-29 Strategic Plan with a strong focus on implementation and capacity building following an intensive period of standard setting work.

The ExCo also touched on IAIS implementation assessment activities, including progress monitoring of the Holistic Framework supervisory material, peer review on ICP 16 (Enterprise Risk Management for Solvency Purposes) and the upcoming member assessment programme (MAP) on the Sultanate of Oman.

The session closed with an exchange with the audience, focusing on the role of supervisors in addressing protection gaps and promoting adaptation and risk mitigation, coordination across jurisdictional initiatives to address emerging risks, how insurers relate to and differ from other financial institutions, and efforts towards actuarial capacity building for implementing risk-based capital regimes.

A key highlight of the Q and A session was a reflection of the immediate past ExCo Chair Vicky Saporta on lessons learnt during her term as IAIS ExCo Chair, with emphasis on the critical importance of recognising the inclusive nature of the IAIS and the value it brings to all markets and gets from its members.

Gary Anderson – Vice Chair, IAIS Executive Committee and Commissioner, Massachusetts Division of Insurance

Shigeru Ariizumi – Chair, IAIS Executive Committee, Vice Minister for International Affairs, Financial Services Agency of Japan

Peter Braumüller – Chair, IAIS Implementation and Assessment Committee and Managing Director of Insurance and Pension Supervision, Austrian Financial Market Authority

Gerry Cross – IAIS Diversity, Equity and Inclusion Champion and Director of Financial Regulation Policy and Risk, Central Bank of Ireland

Dieter Hendrickx – Chair, IAIS Macroprudential Committee and Head, Prudential Policy Insurance, National Bank of Belgium

Petra Hielkema – IAIS FinTech Champion and Chairperson, EIOPA

Siham Ramli – Vice Chair, IAIS Executive Committee and Director of Communication and International Relations, Autorité de Contrôle des Assurances et de la Prévoyance Sociale Morocco

Vicky Saporta – Past Chair, IAIS Executive Committee and Executive Director, Prudential Regulation Authority and Bank of England

Matt Walker – Chair, IAIS Policy Development Committee and Manager, Insurance Supervision and Regulation Section, Federal Reserve Board of the United States

Daniel Wang – Chair, IAIS Climate Risk Steering Group and Executive Director, Insurance Department, Monetary Authority of Singapore

The role of supervisors in helping to address natural catastrophe protection gaps

“Protection gaps present an existential challenge for our industry”. The panel discussed how supervisors can work with industry, consumers and government to address natural catastrophe (NatCat) protection gaps.

Panellists discussed the significant challenges related to the affordability, availability and uptake for coverage against NatCat events.

“The opportunities are endless – it is a question of how urgently we want to act”.

Panellists outlined opportunities for collaboration, including in:

- Assessing protection gaps

- Improving financial literacy and risk awareness

- Incentivising risk prevention and reduction of insured losses

- Creating an enabling regulatory environment to support availability and uptake of coverage

- Collaboration with government and industry, including in public-private partnership

Moderator:

Shigeru Ariizumi – Chair, IAIS Executive Committee and Vice Minister for International Affairs, Financial Services Agency of Japan

Panellists:

Ekhosuehi Iyahen – Secretary General, Insurance Development Forum

Yoshihiro Kawai – Chairman, OECD Insurance and Private Pension Committee and Chairman, Global Asia Insurance Partnership

Ricardo Lara – Commissioner, California Department of Insurance

Pamela Schuermans – Principal Expert Insurance Policy, EIOPA

Janina Voss – Interim Head of Secretariat, Access to Insurance Initiative

In conversation with Gillian Tett

The IAIS was joined by Gillian Tett, columnist and editorial board member at the Financial Times. She shared her views on global trends impacting the insurance industry, including that cyber and climate are two risks that will shape 2024.

On cyber threats, she stressed that the weakest links in the chain can create cyber disasters in our financial eco system. She further touched on risks arising from the long period of very low interest rates in the recent past, observing that “the global financial market has been drunk on liquidity”.

Finally, she enunciated on risks abounding from a reordering of the geopolitical environment, which is creating more protectionism, more conflict and more wars.

Tett left the audience to ask itself, what is the relationship between business and society, who is going to bear the risks that are hard to insure, and how will that be divided between the public and private sector, noting that in 2024 there will be a lot of risks to price and many consumers who will need insurers to help protect themselves from those risks.

Gillian Tett – Provost Elect, King’s College, Cambridge and columnist and editorial board member, Financial Times

Evolving risks in the global insurance sector

The panel opened with remarks on the economic and financial market outlook by Chang Shu, Chief Asia Economist at Bloomberg. The panel then took to the stage to discuss further these issues, focusing on the challenging environment insurers are navigating and how supervisors are monitoring these risk.

Ms. Shu emphasised the economic headwinds caused by rising inflation and a recessionary outlook, while also noting the strength of consumers as demonstrated by the recent phenomenon referred to as the Taylor Swift and Beyoncé effect in the US.

The panel further discussed these issues, focusing on the challenging environment insurers are navigating, characterised by increased interest rates, liquidity and credit risks (such as in real estate and fixed-income portfolios).

Insurers and supervisors are increasingly monitoring these risks, including through deep-dive assessments of portfolios, stress testing, hedging of risks and the development of in-depth risk metrics.

Panellists went on to discuss structural shifts in the life insurance sector such as the increase in both allocations to alternative investments and the use of cross-border asset-intensive reinsurance. While recognising that privately placed and structured assets have benefits, such as funding the real economy, the panel noted that risks associated with these assets include less transparency, less liquidity, more complexity and thus more challenges in terms of risk measurement and valuation.

To mitigate these risks, panellists emphasised the importance of strengthening models, raising awareness and ensuring boards are strong and diverse.

Moderator:

Lara K. Lylozian – Deputy Associate Director and Chief Accountant, Federal Reserve Board

Panellists:

Dieter Hendrickx – Chair, IAIS Macroprudential Committee and Head, Prudential Policy Insurance, National Bank of Belgium

Ronnie Garreaud – Global Head Risk Insurance Coverage, Allianz

Fundi Tshazibana – Deputy Governor and CEO Prudential Authority, South African Reserve bank

Marjan van der Weijden – Global Head of Financial Institutions and DEI Chair, Fitch Ratings

Keynote speech

Keiko Honda, Adjunct Professor, School of International and Public Affairs, Columbia University, opened the second day of the Annual Conference stating that “the insurance industry is at a crossroads”.

With risks from climate change, infectious diseases, war and civil disturbance and cyber increasing, she contends that not only policyholders but also many others benefit from insurance.

Ms. Honda touched upon the benefits of insurance from the perspective of financial inclusion and also the increasing importance that consumers place on ESG – consumers choose insurance not only based on the coverage offered but also based on the ESG ratings of the insurance provider.

She cited the IAIS Global Insurance Market Report (GIMAR) publication as a useful tool to assess the overall stability of the financial system and highlighted that more can be done still to improve underwriting guidelines for insurance companies.

In conclusion, Ms. Honda raised three questions to set the scene for the rest of the day:

- How can insurance data best be used to assess the current and future impact of climate change?

- Is some insurance a public good and should there be a minimum protection for the most vulnerable?

- What can be done to better educate consumers on the benefits of insurance in climate risk mitigation?

Keiko Honda – Adjunct Professor, School of International and Public Affairs, Columbia University

Embedding customer-centric outcomes in the insurance sector

The panel put consumers’ interests at the core of insurance provision. Including with respect to product design, product delivery, and product servicing. After all, what is the insurance sector and the supervision of it for, if not to deliver insurance that meets the needs and expectations of consumers.

Panellists exchanged thoughts on the biggest risks to good consumer outcomes. While climate risk was cited, moreover they identified improvements still to be made when it comes to the fundamentals:

- Designing good value products, that are sold only to customers for whom they are suitable

- Fair and timely claims settlement

- Insurers making better use of the data they have to improve their conduct of business

The panel also expanded on how to achieve fairer treatment and better outcomes for diverse consumers, meaning consumers who are vulnerable, under-served, minority or have different needs in comparison with a normative or dominant consumer profile.

The panellists representing consumers expressed strong caution against targeting diverse consumers in an attempt to sell increasing amounts of insurance. Instead, the focus should be on making products and processes work better for a broader range of consumers. Doing so will ultimately benefit all consumers. Product complexity and lengthy disclosures are not good for anyone.

Moderator:

Andrew N. Mais – Insurance Commissioner, Connecticut and President-elect, NAIC

Panellists:

Karen Cox – CEO, Financial Rights Legal Centre

Shinichi Kishi – General Manager, Sustainability Management & Development Dpt., Meiji Yasuda Life Insurance Company

Indrani Thuraisingham – Vice President and Legal Advisor, Federation of Malaysian Consumers Associations

Mark White – Chair, IAIS Market Conduct Working Group and CEO, Financial Service Regulatory Authority of Ontario

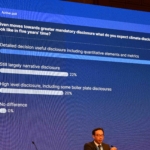

Data, transparency and disclosure: Evolving supervisory practices to tackle climate risk

The panel discussed the steps to improve transparency on climate-related risks and create consistent and decision-useful climate disclosure in order to allow better assessment of financial risks and reduce the risk of greenwashing.

In her opening remarks, Sue Lloyd, Vice-Chair of the International Sustainability Standards Board (ISSB), shared her appreciation of the IAIS public support to the ISSB standards. She stressed that the priorities of the coming period will be on implementation of the standards.

To support this, the panellists highlighted:

- The importance of an internationally accepted baseline reporting standard, to help reduce the fragmentation of reporting standards

- Disclosure to cover not only the expected impact of climate risks but also tail risks

- The need for supervisors to establish consistent climate-related reporting requirements

- The different speeds and maturity of countries’ net zero transition plans impact availability and quality of data for climate disclosure

- Finally, clear country level transition pathways are key for reducing the risk of greenwashing

Also, it was recognised that disclosure practices are still not mature. Therefore, aiming for too much accuracy may be a barrier for their continuous improvements.

The poll among the audience indicated that even insurers themselves do not yet have sufficiently granular data on physical risks to understand their exposures on both sides of their balance sheet.

Moderator:

Beth Dwyer – Superintendent of Insurance, Rhode Island Department of Business Regulation and Vice Chair, IAIS Climate Risk Steering Group

Panellists:

Andreas Märkert – Chief Risk Officer, Hannover Re

Ken Mungan – Chairman, Milliman

Masaaki Nagamura – Fellow International Initiatives, Tokio Marine

Daniel Wang – Chair, IAIS Climate Risk Steering Group and Executive Director, Insurance Department, Monetary Authority of Singapore

Insurance Capital Standard: One year to finalisation

The Annual Conference concluded with a panel on the Insurance Capital Standard (ICS), where the latest updates on the finalisation of the ICS were provided and Shigeru Ariizumi, IAIS Executive Committee Chair, confirmed his commitment to taking the ICS “the final mile to implementation”.

Paolo Cadoni, Chair of the IAIS Capital, Solvency and Field Testing Working Group provided in his opening remarks a general retrospective on the ICS, as well as an update on its latest developments.

The session reflected on progress and momentum in finalising the ICS, which is one of the most tested international standards, including:

- An update on responses received to the ICS consultation.

- Developments on the implementation of the ICS in EU, Japan and UK.

- An update on next steps on the Comparability Assessment, which is proceeding in line with the timeline, methodology, process and governance as agreed upon by the IAIS and currently being undertaken by a team of technical experts within the IAIS Secretariat.

Audience discussion centred on implementation of the ICS and how it will consider local specificities. The panel also indicated that the IAIS is working on providing further details on the implementation of the ICS for Internationally Active Insurance Groups (IAIGs).

Read further on the ICS

Learn more about the comparability assessment

Moderator:

Romain Paserot – IAIS Deputy Secretary General and IAIS Head of Capital and Solvency

Panellists:

Shigeru Ariizumi – Chair, IAIS Executive Committee, Vice Minister for International Affairs, Financial Services Agency of Japan

Gary Anderson – Vice Chair, IAIS Executive Committee and Commissioner, Massachusetts Division of Insurance

Petra Hielkema – Chairperson, EIOPA

Vicky Saporta – Past Chair, IAIS Executive Committee and Executive Director, Prudential Regulation Authority and Bank of England

Closing remarks

Jonathan Dixon, IAIS Secretary General, closed the Annual Conference by highlighting key messages around the societal role of insurance that arose throughout the conference. He further thanked guest speakers, panellist, participants and the hosts for such a rich two days of discussion and engagement.

Dixon highlighted the special honour of having the Prime Minister of Japan and the Minister of State for Financial Services share welcoming remarks for the conference.

“Their attendance is recognition of the important role the insurance sector has to play in confronting today’s societal challenges – and the significant role of the IAIS, and forums like this, in coming together to address global challenges.”

He summarised the key messages from Prime Minister Kishida, which were further emphasised throughout the two-day programme:

- Tackling societal challenges and generating

- Sustainable growth require us to unlock the fundamental strengths of insurance.

The role of insurance in addressing various societal challenges will continue to grow. For insurance to fully perform its roles, it is critical that insurers maintain their financial soundness – supported by sophisticated governance and risk management, and the trust of consumers – and accordingly, effective regulation and supervision is critical.

It is also becoming increasingly important that the public and private sectors take collective action to address societal challenges, including climate change and natural disasters.

To tackle these common challenges, supervisors around the world need to find global solutions collectively and collaboratively – which is precisely the focus of the IAIS.

Jonathan Dixon – IAIS Secretary General

Speakers

Vice Chair, IAIS Executive Committee and Commissioner, Massachusetts Division of Insurance

Chair, IAIS Executive Committee and Vice Minister for International Affairs, Financial Services Agency of Japan

Chair, IAIS Implementation and Assessment Committee and Managing Director of Insurance and Pension Supervision, Austrian Financial Market Authority

Vice Chair, IAIS Policy and Development Committee and Head, Insurance Policy Division, Bank of England

CEO, Financial Rights legal Centre

IAIS Diversity, equity and inclusion champion and Director of Financial Regulation Policy and Risk, Central Bank of Ireland

Secretary General, IAIS

Superintendent of Insurance, Rhode Island Department of Business Regulation

Executive Director, Risk Assessment and Intervention Hub, Supervision Sector, Office of the Superintendent of Financial Institutions

Global Head Risk Insurance Coverage, Allianz

Immediate Past President, International Actuarial Association

Chair, IAIS Macroprudential Committee and Head, Prudential Policy Insurance, National Bank of Belgium

IAIS FinTech Champion and Chairperson, European Insurance and Occupational Pensions Authority

Adjunct Professor/Adjunct Senior Research Scholar, Columbia University, School of International and Public Affairs

Secretary General, Insurance Development Forum

Chairman, OECD Insurance and Private Pension Committee

General Manager, Sustainability Management and Development Department, Meiji Yasuda Life Insurance Company

Fumio Kishida

Prime Minister, Japan

Commissioner, California Department of Insurance

Vice-Chair of the International Sustainability Standards Board

Chief Accountant and Deputy Associate Director, Division of Supervision and Regulation, Board of Governors of the Federal Reserve System

Chief Risk Officer, Hannover Re

Insurance Commissioner, Connecticut and President-elect, NAIC

Chairman, Milliman

Fellow International Initiatives, Tokio Marine Holdings, Inc.

IAIS Deputy Secretary General and IAIS Head of Capital and Solvency

Vice Chair, IAIS Executive Committee and Director of Communication and International Relations, Autorité de Contrôle des Assurances et de la Prévoyance Sociale Morocco

Past Chair, IAIS Executive Committee and Executive Director, Prudential Regulation Authority and Bank of England

Bloomberg Chief Asia Economist

Principal Expert on Insurance Policy, EIOPA

Chair, IAIS Financial Inclusion Forum and General Superintendent of Insurance, Costa Rica

Chair, IAIS Risk-based Solvency Implementation Forum and Actuary, Prudential Authority, South African Reserve Bank

Shunichi Suzuki

Minister of Finance, Japan

Provost Elect, King’s College, Cambridge, and columnist and editorial board member, Financial Times

Vice President and Legal Advisor, Federation of Malaysian Consumers Associations

Deputy Governor, South African Reserve Bank and CEO, Prudential Authority

Global Head of Financial Institutions at Fitch Ratings

Vice Chair, Market Conduct Working Group and Manager, Insurance Supervision, Dutch Authority for the Financial Markets

Interim Head of Secretariat, Access to Insurance Initiative (A2ii)

Chair, IAIS Policy Development Committee and Manager, Insurance Supervision and Regulation Section, Federal Reserve Board of the United States

Chair, IAIS Climate Risk Steering Group and Executive Director, Insurance Department, Monetary Authority of Singapore

Chair, Market Conduct Working Group and CEO, Financial Service Regulatory Authority of Ontario